Many businesses in various industries, especially in the financial sector, are regaining stability during the novel coronavirus pandemic. Since the disease outbreak started, enterprises were forced to change their operations while adhering to confinement measures, resulting in the boom of remote services.

During the pandemic, there was a rapid growth of digital banking because of the significant increase in the use of the internet and mobile devices. Because of technological innovation, it has become possible for traditional banking services to be delivered online, providing a more seamless and engaging customer experience.

The possibility of carrying out digital transactions from home offers advantages for users. Still, there are risks that both customers and financial institutions have to look out for.

Remote banking and other financial processes require a high level of security and trust between customers and providers. These financial institutions need to ensure that their customers are who they claim to be. Identity theft can cause a significant amount of damage to the businesses such as monetary losses and customer distrust. Therefore, a more secure customer identity verification is crucial.

They must observe Anti-Money Laundering (AML), Know-Your-Customer (KYC), and Payment Services Directive 2 compliance for strong identity verification.

People are accustomed to using passwords for identity authentication in various accounts. However, it has become outdated, opening the doors to security threats. Verizon’s recent Data Breach Investigations Report (DBIR) found that one of the primary causes of data breaches was due to fraudsters who used stolen credentials or brute force.

Many financial companies still utilize passwords for authentication methods, but they prove ineffective in keeping bank account access secure. If banks intend to go fully digital, they must consider biometric identification solutions for passwordless login to enhance their defenses against illicit account access.

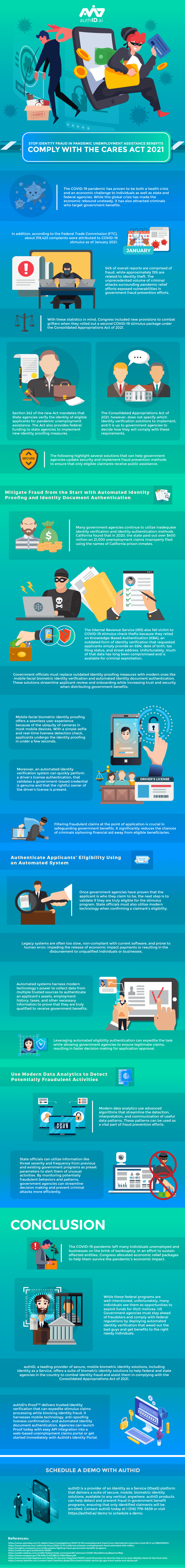

Learn more about passwordless digital banking in this infographic from authID.

You may also want to read,