Buying a car can be considered a significant achievement on the new owner’s part since it took plenty of time and effort to gather the necessary funds to make the purchase. Losing their prized vehicle so suddenly can cripple the owner’s finances and their spirit since they potentially wasted money on something they can’t enjoy. Without car insurance, people are at risk of sustaining significant financial damage when caught in a road accident.

Many people believe that not getting insured is okay since they’re quite pricey. However, there’s no fixed rate for car insurance plans, and car owners can get a relatively cheap one that can cover their needs without being too costly.

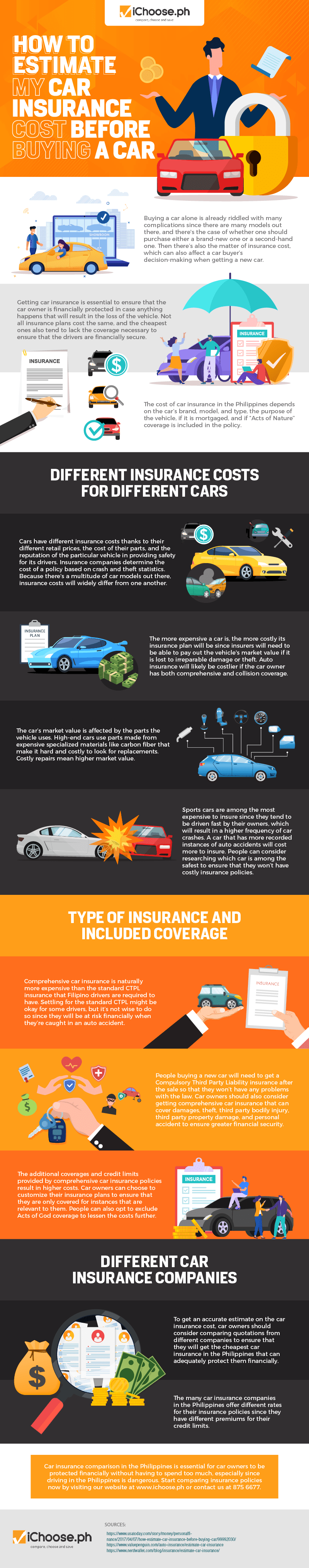

Even before someone buys a car, they can estimate how much an insurance plan will cost depending on the car’s retail price. The vehicle’s spare parts and reputation for safety can also influence how much the insurance policy costs.

Both the type of insurance policy and the insurer the car owner will get it from can also affect the insurance’s cost. Car owners can compare insurance plans to ensure that they get the most affordable plan they need. See this infographic by iChoose.ph for more information on estimating car insurance costs.